Sandisk’s 1000% Rally Explained: AI, Data Centers & What’s Next

Introduction: Sandisk’s Historic Stock Explosion

In one of the most remarkable stock market rallies in recent history, Sandisk has delivered a jaw-dropping performance, surging over 1,000% in just six months and becoming one of the best-performing stocks not only in the S&P 500, but across the entire global equity market. Once known mainly for consumer memory cards and USB drives, Sandisk has transformed into a critical backbone of the artificial intelligence revolution—fueling massive investor excitement and reshaping its long-term valuation story.

What Is Sandisk and Why It Matters Today

Sandisk is a pioneer in NAND flash memory technology, originally founded in 1988 and taken public in 1995. While it became a household name for consumer storage products, its true strategic importance lies in enterprise-grade solid-state drives (SSDs) and high-performance flash memory used in servers, data centers, and AI infrastructure. In an era where data is the new oil, Sandisk has positioned itself as a key supplier of the storage systems that power modern computing.

From Western Digital Spin-Off to Market Darling

Sandisk’s modern resurgence began after its spin-off from Western Digital in February 2025. For years, Sandisk’s value was buried inside Western Digital’s broader HDD-focused business. The separation unlocked investor visibility, allowing markets to correctly price Sandisk as a pure-play AI and data-storage growth company. Since the spin-off, the stock has climbed nearly 1,200%, validating the strategic decision.

Why AI Is the Core Driver of Sandisk’s Rally

Artificial intelligence workloads are incredibly data-intensive. Training and running AI models require massive, fast, power-efficient storage, and traditional hard drives simply cannot keep up. Sandisk’s NAND-based SSDs offer high throughput, low latency, and energy efficiency—making them essential for AI inference and training clusters. As AI adoption accelerates, demand for Sandisk’s products has exploded.

Hyperscalers Are Fueling Explosive Demand

The world’s largest technology companies—often referred to as hyperscalers—are investing billions into AI data centers. Sandisk has confirmed active relationships with five major hyperscale customers, supplying storage solutions designed for AI-optimized server architectures. These long-term partnerships provide predictable revenue growth and pricing power that investors highly value.

Data Centers: The Hidden Growth Engine

While consumer storage remains important, Sandisk’s data center segment is now its most powerful growth lever. Revenue from data centers rose sharply quarter-over-quarter, driven by demand for high-capacity SSDs used in AI clusters, cloud computing, and edge computing environments. Analysts widely agree this segment could soon rival or exceed Sandisk’s traditional businesses.

Edge Computing Expands Sandisk’s Reach

Beyond centralized data centers, Sandisk benefits from the rise of edge computing—where data is processed closer to the source. Autonomous vehicles, industrial robots, security cameras, drones, and smart factories all rely on embedded storage. Sandisk dominates this niche, giving it diversified growth beyond cloud giants.

NAND Supply Tightness Boosts Pricing Power

Another critical factor behind Sandisk’s rally is tight NAND supply. Industry analysts expect NAND memory to remain undersupplied through at least 2026, while demand surges due to AI workloads. This imbalance allows Sandisk to raise prices—particularly for high-capacity 3D NAND used in enterprise SSDs—significantly improving margins.

Analysts Turn Aggressively Bullish on Sandisk

Major banks and research firms have revised their outlooks upward. Citi, for example, sharply increased earnings estimates and price targets after meeting Sandisk executives at CES 2026. Analysts cited management’s confidence, hyperscaler demand, and constructive NAND fundamentals as reasons Sandisk stands out among all AI-linked hardware stocks.

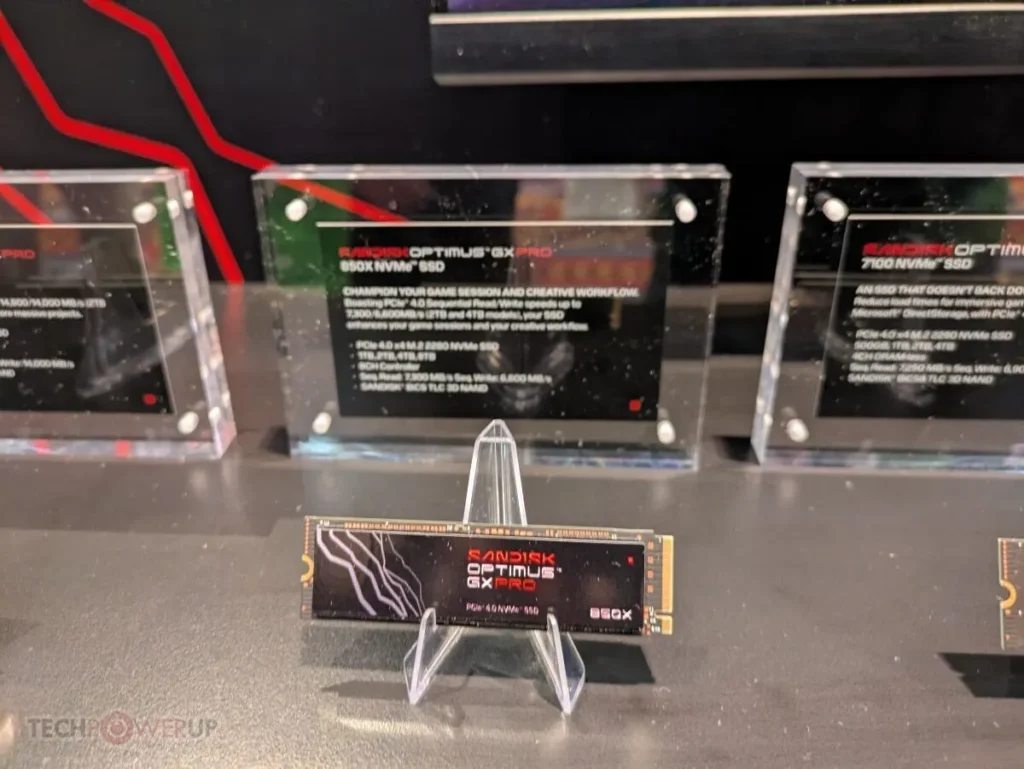

CES 2026: A Major Catalyst Moment

Sandisk’s momentum accelerated after CES 2026, where the company unveiled its Optimus SSD brand, along with GX and GX Pro product tiers. These solutions target AI workloads, creators, and high-performance gaming—signaling Sandisk’s intent to dominate both enterprise and premium consumer markets.

Financial Performance That Justified the Hype

In its most recent earnings report, Sandisk posted 23% year-over-year revenue growth, beating guidance. While short-term earnings fluctuated due to heavy investment, management emphasized long-term profitability as data center margins expand. Investors rewarded the company for prioritizing strategic dominance over near-term optics.

Revenue Breakdown Shows Balanced Growth

Sandisk’s revenue growth is not dependent on a single segment. Data center, edge, and consumer divisions all posted double-digit growth. This diversification reduces risk and strengthens Sandisk’s ability to weather cyclical downturns in any one market.

AI Infrastructure Spending Could Hit Trillions

Sandisk’s CEO highlighted estimates that global AI infrastructure spending could exceed $1 trillion by 2030, with some forecasts—such as Nvidia’s—even higher. Storage is a foundational layer of this spending, positioning Sandisk to capture a substantial share of this capital wave.

Valuation: Expensive or Still Reasonable?

Despite its massive run, Sandisk’s valuation remains surprisingly reasonable relative to growth. Its forward P/E and price-to-sales ratios are modest compared to other AI leaders. Markets appear to be pricing Sandisk as an infrastructure enabler, not a speculative bubble stock.

Why Sandisk Outperformed Nvidia and Big Tech

Unlike Nvidia, which dominates compute, Sandisk focuses on data movement and storage, a less crowded but equally essential part of the AI stack. This allowed Sandisk to outperform even the “Magnificent Seven” as investors sought exposure beyond GPUs.

Risks Investors Should Still Consider

No rally is risk-free. NAND pricing cycles, capital expenditure requirements, and macroeconomic slowdowns could affect Sandisk’s momentum. Competition from other storage makers also remains a long-term consideration, though Sandisk currently holds a technological edge.

Can Sandisk Repeat This Performance?

While another 1,000% rally is unlikely in the near term, analysts believe Sandisk still has meaningful upside. The company’s growth window is measured in years, not quarters, as AI adoption remains in early innings.

Is Sandisk the Smartest Investment Today?

For investors seeking exposure to AI without betting solely on compute chips, Sandisk represents a compelling alternative. Its role in data infrastructure, pricing power, and strategic clarity make it one of the most attractive AI-adjacent stocks in the market today.

What This Rally Tells Us About the AI Market

Sandisk’s rise underscores a critical lesson: AI is not just about flashy GPUs and software. Storage, bandwidth, and data management are just as vital—and companies solving those bottlenecks can deliver extraordinary returns.

Final Answer: Why Did Sandisk Stock Surge 1000%?

Sandisk stock surged over 1,000% due to a perfect storm of AI-driven demand, data center expansion, NAND supply constraints, strategic spin-off execution, and strong financial performance. The rally reflects a fundamental re-rating of Sandisk’s role in the global AI infrastructure ecosystem.

Conclusion: Sandisk’s New Identity Is Here to Stay

Sandisk is no longer just a storage brand—it is a core AI infrastructure company. Its meteoric rise may mark the beginning of a long-term transformation rather than the end of a cycle. For investors, Sandisk’s story is a reminder that sometimes, the biggest winners are hiding in plain sight.