The Smart Way to Boost Your Health Coverage

Imagine paying just ₹3,500 annually to add ₹10 lakhs of health coverage on top of your existing ₹5 lakh policy. Sounds too good to be true? This is exactly what top-up health insurance offers—a cost-effective solution to dramatically increase your protection without breaking your budget.

In 2025, healthcare costs in India have skyrocketed. A single cardiac surgery can cost ₹8-12 lakhs, cancer treatment easily crosses ₹15-20 lakhs, and even routine hospitalizations for dengue or appendicitis run into ₹50,000-80,000. If you bought a ₹5 lakh policy a few years ago thinking it was adequate, you’re likely underinsured today.

Upgrading from a ₹5 lakh policy to a ₹25 lakh comprehensive policy would cost ₹30,000-40,000 annually for most families. But here’s the smart alternative: keep your ₹5 lakh base policy (costing ₹15,000) and add a ₹20 lakh top up health insurance plan (costing just ₹4,000-5,000). Total investment: ₹19,000-20,000 for ₹25 lakh coverage—saving you 50% compared to buying a standalone ₹25 lakh policy.

But how top up health insurance works isn’t always intuitive. The concept of deductibles, the difference between top-up and super top-up, and knowing when these plans activate—these details confuse many buyers. This comprehensive guide explains everything with real examples, helping you make an informed decision about whether a top-up plan is right for you.

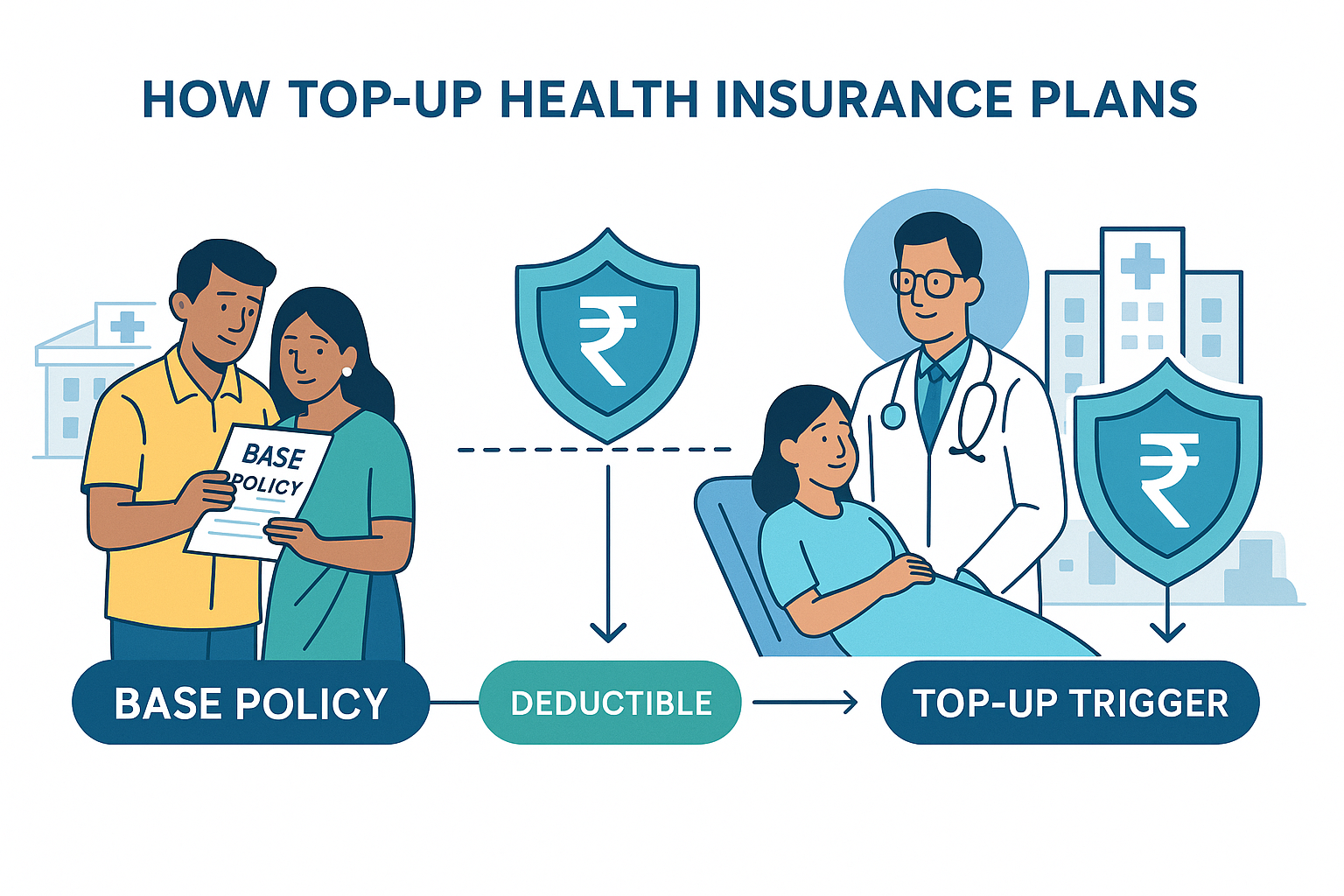

What Is a Top-Up Health Insurance Plan?

A top-up health insurance plan is additional coverage that activates only after you’ve exhausted a certain amount called the “deductible.” Think of it as backup coverage that kicks in for large medical bills beyond your primary policy’s capacity.

Simple Definition:

A top-up plan provides extra sum insured at a fraction of the cost of a regular policy, but it only pays claims above a specified deductible amount.

Key Components:

Deductible: The threshold amount you must cross before the top-up plan starts paying. Common deductibles are ₹3 lakhs, ₹5 lakhs, ₹7 lakhs, or ₹10 lakhs.

Sum Insured: The additional coverage amount provided by the top-up—typically ₹10 lakhs, ₹20 lakhs, ₹50 lakhs, or even ₹1 crore.

Premium: The yearly cost, which is significantly lower than standalone policies because the deductible reduces the insurer’s risk.

Why Top-Up Plans Are Cheaper Than Base Policies:

The mathematics is simple: insurance companies pay claims less frequently on top-up plans because most hospitalizations fall below the deductible threshold.

Example Comparison:

Standalone ₹20 Lakh Policy:

- Annual Premium: ₹28,000-35,000

- Covers every hospitalization from ₹1 to ₹20 lakhs

- Higher claim frequency (many small claims + few large claims)

₹20 Lakh Top-Up with ₹5 Lakh Deductible:

- Annual Premium: ₹4,000-6,000

- Covers only hospitalizations above ₹5 lakhs

- Lower claim frequency (only large claims trigger it)

- Company’s risk reduces by 70-80%

Why This Works:how

- 80% of hospitalizations cost under ₹3 lakhs

- 95% cost under ₹5 lakhs

- Only 5% exceed ₹5 lakhs

Since the top-up plan only activates for that rare 5% of expensive hospitalizations, the insurer’s exposure is minimal—hence the dramatically lower premium.

Real-World Cost Comparison:

Scenario: 35-year-old couple with 2 children

Option A – Standalone ₹25 Lakh Family Floater:

- Annual Premium: ₹32,000

- Coverage: ₹25 lakhs

Option B – ₹5 Lakh Base + ₹20 Lakh Top-Up (₹5L deductible):

- Base Policy Premium: ₹15,000

- Top-Up Premium: ₹4,500

- Total Annual Premium: ₹19,500

- Combined Coverage: ₹25 lakhs

- Savings: ₹12,500 annually (39%)

Over 10 years, this saves ₹1.25 lakhs while providing identical ₹25 lakh coverage for major illnesses.

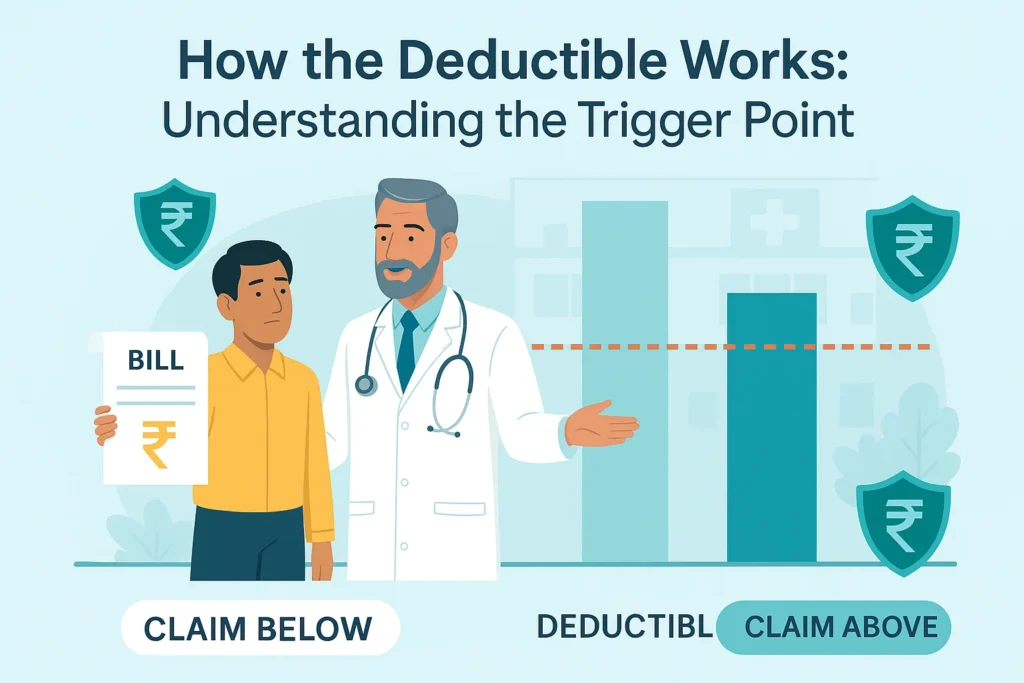

How the Deductible Works: Understanding the Trigger Point

The deductible health insurance concept is the foundation of how top-up plans function. Let’s break this down with crystal-clear examples.

What Is a Deductible?

A deductible is the amount you must pay (or have covered by another policy) before your top-up plan begins paying.

Important: The deductible doesn’t mean you pay from your pocket—it can be paid by your base health insurance policy. The deductible is simply the threshold that must be crossed.

How Deductible Activates: Step-by-Step

Your Setup:

- Base Policy: ₹5 lakh coverage

- Top-Up Plan: ₹20 lakh coverage with ₹5 lakh deductible

- Total Protection: Up to ₹25 lakhs

Scenario 1: Small Hospitalization (₹2 Lakhs)

Situation: You’re hospitalized for appendicitis. Total bill: ₹2 lakhs.

What Happens:

- Bill amount: ₹2 lakhs

- Deductible threshold: ₹5 lakhs (not crossed)

- Base policy pays: ₹2 lakhs

- Top-up pays: ₹0 (not activated)

- Your out-of-pocket: ₹0

Result: Base policy handles it completely. Top-up remains unused.

Scenario 2: Medium Hospitalization (₹4.5 Lakhs)

Situation: You need surgery for kidney stones. Total bill: ₹4.5 lakhs.

What Happens:

- Bill amount: ₹4.5 lakhs

- Deductible threshold: ₹5 lakhs (not crossed)

- Base policy pays: ₹4.5 lakhs

- Top-up pays: ₹0 (not activated)

- Your out-of-pocket: ₹0

Result: Still under deductible. Base policy covers entirely. Top-up doesn’t activate.

Scenario 3: Large Hospitalization (₹8 Lakhs) – Top-Up Activates!

Situation: You suffer a heart attack requiring angioplasty and 5-day ICU stay. Total bill: ₹8 lakhs.

What Happens:

- Bill amount: ₹8 lakhs

- Deductible threshold: ₹5 lakhs (crossed!)

- Base policy pays: ₹5 lakhs (exhausted)

- Remaining bill: ₹3 lakhs

- Top-up pays: ₹3 lakhs

- Your out-of-pocket: ₹0

Result: Base policy paid first ₹5 lakhs. Top-up kicked in for the remaining ₹3 lakhs. You’re fully covered.

Scenario 4: Very Large Hospitalization (₹18 Lakhs)

Situation: Cancer treatment requiring surgery, chemotherapy, and radiation. Total bill: ₹18 lakhs.

What Happens:

- Bill amount: ₹18 lakhs

- Deductible threshold: ₹5 lakhs (crossed)

- Base policy pays: ₹5 lakhs (exhausted)

- Remaining bill: ₹13 lakhs

- Top-up pays: ₹13 lakhs

- Your out-of-pocket: ₹0

Result: Base policy exhausted. Top-up covered ₹13 lakhs. Full protection achieved.

Scenario 5: Catastrophic Hospitalization (₹30 Lakhs)

Situation: Major accident requiring multiple surgeries, ICU for 20 days, and rehabilitation. Total bill: ₹30 lakhs.

What Happens:

- Bill amount: ₹30 lakhs

- Deductible threshold: ₹5 lakhs (crossed)

- Base policy pays: ₹5 lakhs (exhausted)

- Remaining bill: ₹25 lakhs

- Top-up coverage limit: ₹20 lakhs

- Top-up pays: ₹20 lakhs (maximum limit reached)

- Your out-of-pocket: ₹5 lakhs

Result: Your ₹25 lakh combined coverage paid ₹25 lakhs (₹5L base + ₹20L top-up). You pay the remaining ₹5 lakhs from savings or additional coverage.

Key Deductible Principles:

1. Deductible Applies Per Claim (Regular Top-Up):

In a standard top-up, the deductible applies to each individual hospitalization claim. If you have two separate hospitalizations in a year, both must cross the deductible independently.

Example:

- First hospitalization: ₹4 lakhs (below ₹5 lakh deductible → top-up doesn’t pay)

- Second hospitalization: ₹6 lakhs (crosses ₹5 lakh deductible → top-up pays ₹1 lakh)

2. Base Policy Not Mandatory:

You can buy a top-up without a base policy, but then you’d pay the deductible from your pocket, which defeats the purpose.

3. Deductible Can Match Any Amount:

You can choose a deductible equal to your corporate insurance (₹3 lakhs), your existing policy (₹5 lakhs), or any amount you’re comfortable paying.

Top-Up vs Super Top-Up: The Critical Difference

This is where many people get confused. Top up vs super top up seems like a minor variation, but the difference is huge and impacts how claims are paid.

Standard Top-Up Plan:

Deductible applies to EACH CLAIM separately.

Your Setup:

- Top-Up: ₹20 lakhs with ₹5 lakh deductible

Scenario – Multiple Hospitalizations in One Year:

Hospitalization 1: Dengue treatment – ₹2 lakhs

- Below ₹5 lakh deductible → Top-up pays: ₹0

Hospitalization 2: Fracture surgery – ₹3.5 lakhs

- Below ₹5 lakh deductible → Top-up pays: ₹0

Hospitalization 3: Appendicitis – ₹2.8 lakhs

- Below ₹5 lakh deductible → Top-up pays: ₹0

Total medical expenses: ₹8.3 lakhs

Top-up paid: ₹0 (because no single claim exceeded ₹5 lakhs)

Problem: Even though your total medical expenses (₹8.3 lakhs) far exceeded the deductible, the top-up didn’t activate because each individual claim stayed below ₹5 lakhs.

Super Top-Up Plan:

Deductible applies to AGGREGATE (total) claims in a policy year.

Your Setup:

- Super Top-Up: ₹20 lakhs with ₹5 lakh aggregate deductible

Same Scenario – Multiple Hospitalizations:

Hospitalization 1: Dengue treatment – ₹2 lakhs

- Cumulative expenses: ₹2 lakhs (below ₹5 lakh aggregate) → Super top-up pays: ₹0

Hospitalization 2: Fracture surgery – ₹3.5 lakhs

- Cumulative expenses: ₹5.5 lakhs (crossed ₹5 lakh aggregate threshold!)

- Super top-up pays: ₹0.5 lakh (the amount above ₹5 lakh deductible)

Hospitalization 3: Appendicitis – ₹2.8 lakhs

- Cumulative expenses: ₹8.3 lakhs

- Super top-up pays: ₹2.8 lakhs (entire third claim, as deductible already exhausted)

Total medical expenses: ₹8.3 lakhs

Super top-up paid: ₹3.3 lakhs (everything above the ₹5 lakh aggregate deductible)

Advantage: Super top-up provides better protection for multiple hospitalizations in the same year.

Direct Comparison Table:

| Feature | Standard Top-Up | Super Top-Up |

|---|---|---|

| Deductible Application | Per claim | Aggregate (annual total) |

| Multiple Small Claims | May not activate | Activates once total crosses deductible |

| Premium | Lower (₹3,500-4,500 for ₹20L) | Slightly higher (₹5,000-7,000 for ₹20L) |

| Best For | One major illness protection | Multiple hospitalizations protection |

| Claim Frequency | Lower (only big single claims) | Higher (cumulative claims) |

| Value | Good for catastrophic events | Better overall protection |

Which One Should You Choose?

Choose Standard Top-Up If:

- You want the absolute lowest premium

- You have a robust base policy (₹10L+) that handles most scenarios

- You’re specifically protecting against one catastrophic event (major surgery, cancer, accident)

- Your family is generally healthy with rare hospitalizations

Choose Super Top-Up If:

- You can afford slightly higher premium for better coverage

- You have a smaller base policy (₹3-5L) that might exhaust with moderate claims

- You have chronic conditions requiring multiple hospitalizations yearly

- You have elderly parents or young children (more frequent medical needs)

- You want comprehensive protection, not just catastrophic coverage

Expert Recommendation: For most Indian families, super top-up offers better value despite the 15-20% higher premium. The protection against multiple hospitalizations is worth the extra ₹1,500-2,000 annually.

When You Should Buy a Top-Up Health Insurance Plan

Top up health insurance isn’t for everyone. Here’s exactly when it makes sense and when it doesn’t.

Perfect Scenarios for Buying a Top-Up:

1. You Have Employer-Provided Insurance (Most Common Use Case)

Situation: Your company provides ₹3-5 lakh group health insurance, but you worry it’s inadequate.

Solution: Buy a super top-up with deductible matching your corporate cover.

Example:

- Corporate insurance: ₹5 lakhs

- Super top-up: ₹20 lakhs with ₹5 lakh deductible

- Total protection: ₹25 lakhs

- Cost: ₹6,000-7,000 annually (vs ₹30,000+ for standalone ₹25L policy)

Benefits:

- Affordable upgrade to your coverage

- Protection continues if you change jobs (portable)

- Corporate cover handles small claims; top-up handles large ones

Important: Choose super top-up here because corporate policies often have co-payments and sub-limits that might leave gaps. Super top-up’s aggregate deductible provides better secondary coverage.

2. Your Base Policy Sum Insured Is Too Low

Situation: You bought a ₹5 lakh policy years ago. Medical inflation means it’s now insufficient.

Problem: Upgrading to ₹25 lakh policy costs ₹30,000+ annually—budget constraint.

Solution: Keep your ₹5 lakh base policy and add ₹20 lakh super top-up.

Costs:

- Existing ₹5L policy: ₹12,000

- ₹20L super top-up (₹5L deductible): ₹6,000

- Total: ₹18,000 for ₹25L coverage

Vs upgrading to ₹25L standalone: ₹32,000

Savings: ₹14,000 annually (44%)

3. You Want Maximum Coverage on Limited Budget

Situation: You’re 40 years old, have two kids, and want ₹50 lakh coverage for catastrophic events.

Problem: ₹50 lakh standalone policy costs ₹55,000-70,000 annually—unaffordable.

Solution:

- Buy ₹10 lakh base policy: ₹18,000

- Add ₹40 lakh super top-up (₹10L deductible): ₹8,000

- Total: ₹26,000 for ₹50L coverage

Result: You get world-class ₹50 lakh coverage at less than half the cost of a standalone ₹50L policy.

4. Parents’ Health Insurance Is Expensive

Situation: Your parents are 65 years old. Senior citizen policies cost ₹40,000-60,000 for ₹5 lakh coverage.

Strategy:

- Buy ₹5 lakh senior citizen base plan: ₹45,000

- Add ₹15 lakh super top-up (₹5L deductible): ₹12,000

- Total: ₹57,000 for ₹20L coverage

Vs ₹20L standalone senior citizen policy: ₹1,20,000+

Savings: ₹63,000+ annually (over 50%)

When You Should NOT Buy a Top-Up:

1. You Don’t Have a Base Policy

If you have no base health insurance, buying only a top-up means you’d pay the deductible from your pocket for small/medium claims. This defeats the purpose.

Example: You buy ₹20L top-up with ₹5L deductible but no base policy. You’re hospitalized with ₹7L bill. You pay ₹5L from savings, top-up pays ₹2L.

Better approach: Buy ₹5L base policy first, then add top-up.

2. Your Base Policy Already Provides Adequate Coverage

If you already have ₹25-30 lakh coverage through comprehensive standalone policy, adding a top-up is redundant unless you want ₹50L+ coverage for extreme scenarios.

3. You’re Very Young and Healthy with Low Risk

If you’re 25 years old, healthy, with no family medical history, a ₹10 lakh base policy is probably sufficient. Adding a top-up might be over-insurance at this stage.

Better strategy: Buy adequate base coverage (₹10L) and add top-up after 35-40 years when risk increases and premiums are still manageable.

4. You Can’t Afford Any Health Insurance

If budget is extremely tight, prioritize base coverage first. A ₹5 lakh base policy (₹12,000) is more useful than ₹20 lakh top-up with ₹5L deductible (₹6,000) and no base cover.

Top Health Insurance Companies Offering Top-Up Plans in 2025

Let’s compare the best top up health insurance options from leading insurers.

1. HDFC ERGO Health Suraksha Top-Up

Coverage Options: ₹5L to ₹1 Crore

Deductible Options: ₹3L, ₹4L, ₹5L, ₹7.5L, ₹10L

Type: Super Top-Up (aggregate deductible)

Pricing Example (40-year-old individual):

- ₹20L coverage, ₹5L deductible: ₹5,800

- ₹50L coverage, ₹10L deductible: ₹9,200

Key Features:

- Covers 1,000+ day-care procedures

- Pre and post-hospitalization: 60 days each

- No room rent limits

- Worldwide coverage option available

- Automatic restoration of sum insured after exhaustion

Network: 12,000+ hospitals

Claim Settlement Ratio: 95%

Best For: Those wanting comprehensive super top-up with excellent claim settlement track record.

2. Niva Bupa Health Premia Top-Up

Coverage Options: ₹5L to ₹1 Crore

Deductible Options: ₹2L, ₹3L, ₹5L, ₹10L

Type: Super Top-Up

Pricing Example (Family of 4):

- ₹25L coverage, ₹5L deductible: ₹8,500

- ₹50L coverage, ₹10L deductible: ₹13,000

Key Features:

- Unlimited automatic restoration

- Zero deductible for accidents (accident claims don’t count toward deductible)

- Covers AYUSH treatments

- No pre-policy medical tests up to 45 years

- International treatment covered

Network: 9,000+ hospitals

Claim Settlement Ratio: 95%

Best For: Families wanting unlimited restoration and accident coverage without deductible.

3. Star Health Super Surplus Top-Up

Coverage Options: ₹5L to ₹50L

Deductible Options: ₹3L, ₹5L, ₹7L, ₹10L

Type: Super Top-Up

Pricing Example (Individual, 35 years):

- ₹15L coverage, ₹5L deductible: ₹4,200

- ₹30L coverage, ₹10L deductible: ₹7,800

Key Features:

- Covers pre-existing diseases after 2 years (vs 3-4 years in other policies)

- Daily hospital cash benefit

- Free annual health check-up

- Domiciliary hospitalization covered

- Covers 197 day-care procedures

Network: 14,000+ hospitals (largest in India)

Claim Settlement Ratio: 89%

Best For: Those prioritizing extensive hospital network, especially in tier-2 and tier-3 cities.

4. Care Health Advantage Top-Up

Coverage Options: ₹10L to ₹1 Crore

Deductible Options: ₹5L, ₹7.5L, ₹10L, ₹15L

Type: Super Top-Up

Pricing Example (Couple, both 38 years):

- ₹20L coverage, ₹5L deductible: ₹6,500

- ₹50L coverage, ₹10L deductible: ₹11,500

Key Features:

- Covers modern treatments (robotic surgery, stem cell therapy)

- Air ambulance covered

- Second medical opinion service

- No waiting period for accidents

- International hospitalization included

Network: 8,500+ hospitals

Claim Settlement Ratio: 91%

Best For: Those wanting cutting-edge treatment coverage and air ambulance benefit.

5. ICICI Lombard Health Booster Top-Up

Coverage Options: ₹3L to ₹50L

Deductible Options: ₹1L, ₹2L, ₹3L, ₹5L

Type: Super Top-Up

Pricing Example (Individual, 32 years):

- ₹10L coverage, ₹3L deductible: ₹3,200

- ₹25L coverage, ₹5L deductible: ₹5,900

Key Features:

- Lowest deductible option (₹1L) available

- Covers OPD expenses as add-on

- Wellness discount up to 10% for healthy lifestyle

- Covers alternative treatments (Ayurveda, Homeopathy)

- Maternity coverage available

Network: 7,000+ hospitals

Claim Settlement Ratio: 87%

Best For: Younger buyers wanting low deductible options and wellness benefits.

Comparison Summary:

| Insurer | Best Feature | Starting Premium (₹20L/₹5L deductible) | Ideal For |

|---|---|---|---|

| HDFC Ergo | Highest claim settlement (95%) | ₹5,800 | Reliability seekers |

| Niva Bupa | Unlimited restoration | ₹8,500 | Premium features |

| Star Health | Largest hospital network | ₹4,200 | Tier-2/3 city residents |

| Care Health | Modern treatment coverage | ₹6,500 | Advanced care needs |

| ICICI Lombard | Low deductible options | ₹5,900 | Budget-conscious buyers |

Pro Tips for Buying Top-Up Health Insurance

1. Match Deductible to Base Coverage

Always set your top-up deductible equal to or slightly below your base policy sum insured.

Example:

- Base policy: ₹5 lakhs → Top-up deductible: ₹5 lakhs ✅

- Base policy: ₹5 lakhs → Top-up deductible: ₹3 lakhs ⚠️ (Gap coverage—more complex)

- Base policy: ₹5 lakhs → Top-up deductible: ₹7 lakhs ❌ (Creates ₹2L gap)

2. Choose Super Top-Up Over Standard Top-Up

Unless premium difference is significant (over 40%), always opt for super top-up for its aggregate deductible benefit.

3. Buy Early for Lower Premiums

Top-up premiums increase with age. Buying at 35 vs 45 can save 30-40% over 10 years.

Example – ₹20L Super Top-Up, ₹5L Deductible:

- Age 35: ₹5,500/year

- Age 45: ₹9,500/year

- 10-year cost difference: ₹40,000

4. Check Restoration Benefits

Some top-ups offer automatic restoration—if sum insured exhausts, it replenishes for subsequent claims in the same year. This is valuable for families with multiple members.

5. Verify Network Hospitals

Ensure your preferred hospitals are in the insurer’s network for cashless treatment convenience.

6. Read Waiting Period Clauses

Most top-ups have:

- 30-day initial waiting period

- 2-4 years for pre-existing diseases

- 1-2 years for specific diseases (hernia, cataract, etc.)

Buy early to complete waiting periods while you’re healthy.

7. Consider Portability

If you change jobs and lose corporate insurance, you can port your top-up to become a regular plan or adjust the deductible. Check portability rules before buying.

Common Mistakes to Avoid

Mistake 1: Buying Top-Up Without Base Policy

Leaves you exposed to paying deductible from pocket.

Mistake 2: Choosing Too High a Deductible

₹10L deductible might save ₹1,000-2,000 on premium but creates coverage gaps. Balance is key.

Mistake 3: Not Disclosing Medical History

Even in top-up plans, non-disclosure leads to claim rejections. Be honest.

Mistake 4: Assuming Top-Up Covers Everything Base Doesn’t

Top-ups generally mirror base policy exclusions. They’re not gap coverage unless specifically designed that way.

Mistake 5: Ignoring Aggregate vs Per-Claim Deductible

This distinction makes or breaks your coverage for multiple hospitalizations.

Conclusion: Is Top-Up Health Insurance Right for You?

How top up health insurance works is now clear: it’s a cost-effective way to dramatically increase your health coverage by accepting a deductible threshold, with super top-ups offering better protection through aggregate deductible benefits.

Decision Framework:

Buy a Top-Up If:

- You have base coverage (personal or corporate) of ₹3-10 lakhs

- You want to increase total coverage to ₹20-50 lakhs affordably

- You’re okay with base policy handling small/medium claims

- You want catastrophic illness protection at minimal cost

Skip It If:

- You have no base policy (buy base first)

- You already have ₹25L+ comprehensive coverage (unless going for ₹50L+)

- You’re very young with low risk (adequate base coverage sufficient)

Final Recommendations:

For Young Professionals (25-35):

₹10L base + ₹15L super top-up (₹10L deductible) = ₹25L coverage at ₹15,000-18,000/year

For Families (35-50):

₹10L family floater + ₹30L super top-up (₹10L deductible) = ₹40L coverage at ₹24,000-28,000/year

For Those with Corporate Cover:

Keep corporate insurance + ₹25L super top-up (deductible matching corporate cover) at ₹7,000-9,000/year

Related Resources:

- Complete Health Insurance Coverage Guide – Understand what’s covered in base policies

- Best Health Insurance Plans Comparison – Find the right base policy before adding top-up

- Health Insurance Premium Calculator – Compare standalone vs base+top-up costs

Top up health insurance is one of the smartest financial decisions you can make in 2025—dramatically boosting protection while keeping premiums affordable. Understand the deductible, choose super top-up for flexibility, and build a comprehensive coverage strategy that protects your family without straining your budget.